Florida insurance agents are closely examining their marketing dollar allocations, and a significant shift is underway. Traditional digital ad channels like Google Ads and Facebook are becoming less efficient for targeting high-intent auto insurance buyers. In response, agents across the state are reallocating budgets toward a more strategic, results-driven channel: DUI mail leads.

This pivot isn’t just a reaction to ad fatigue or rising click costs. It’s based on strong performance data. When insurance agencies target individuals recently arrested for DUI, particularly those needing FR44 insurance, they reach a segment with immediate needs and limited shopping behavior. That means higher conversion rates, stronger retention, and better long-term ROI.

Why DUI Mail Leads Deliver Stronger Returns

Unlike traditional auto insurance prospects, DUI defendants in Florida are under strict legal pressure to obtain coverage quickly. FR44 insurance requirements mandate higher liability coverage and filing with the state, making these individuals:

- Highly motivated to purchase insurance immediately

- More likely to accept higher premiums

- Less likely to shop around or delay coverage

This urgency gives insurance agents a competitive edge, especially when leads are delivered through timed, localized direct mail campaigns targeting the moment of need.

Direct Mail vs Digital Marketing for Insurance Leads

While digital ad platforms offer broad reach, they also have high competition and lower buyer intent. DUI mail leads, in contrast, offer:

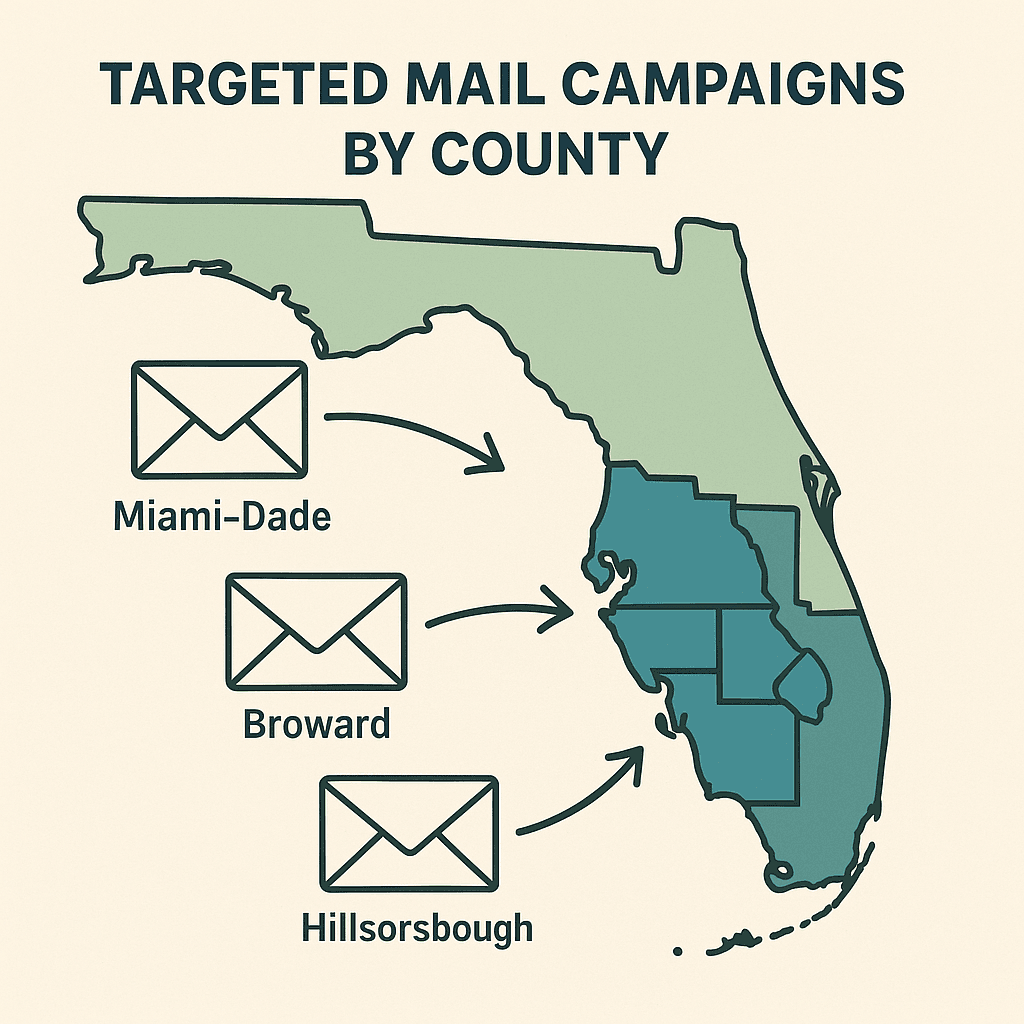

- County-level targeting across Florida

- Filtered lists based on arrest records and filing deadlines

- Precision timing that aligns with court dates, license suspensions, or legal deadlines

Mailers physically arrive when potential clients are looking for solutions, not just browsing. This critical timing affects performance.

"When that mailer hits the mailbox within days of a DUI arrest, it doesn’t just advertise — it solves a problem."

— LegalGrab Campaign Strategy

FR44 Insurance: A Profitable Niche for Florida Agents

Florida is one of only two states that require FR44 insurance for DUI-related offenses, and this niche is profitable. FR44 filings often lead to:

- Premiums 2–4x higher than standard auto policies

- Minimum coverage periods of 3 years

- Lower cancellation and churn rates

Agents who acquire a single FR44 client can expect significantly higher lifetime value than traditional auto policyholders. That’s why smart agencies treat DUI leads not as a risk but a growth opportunity. For a deeper breakdown of how these leads are sourced, visit our page on Florida FR44 and SR22 insurance lead generation.

How Mail Campaigns Are Customized for High Intent

Top-performing insurance agencies in Florida are leveraging custom-designed mail campaigns to improve response rates. Key tactics include:

- Personalized messaging based on county or zip code

- Call-to-action urgency tied to court or license deadlines

- Design elements that highlight compliance with FR44 laws

Check out our guide on email and mail campaign tips for FR44 insurance for real-world examples of how agencies build high-response campaigns.

Cost-Effective Lead Generation for Insurance Agencies

Many Florida insurance agents report a lower cost per acquisition (CPA) through DUI direct mail leads than online ad spend. With digital ad saturation driving up CPCs, agents find that mail-based campaigns offer:

- Lower acquisition costs

- Higher conversion percentages

- Better tracking and list control

When leads are exclusive and pre-qualified based on DUI arrest data, the results often speak for themselves. Learn more in our detailed breakdown: FR44 and SR22 Leads for Florida Insurance Agents.

Combining Mail with Digital for Maximum ROI

For agencies that want to take it a step further, layering in email or SMS follow-ups after the initial mailer can boost contact rates and close ratios. An ideal flow might include:

- Initial direct mail postcard or letter

- Follow-up text offering online quote or call

- Email reminder tied to license reinstatement deadline

This omni-channel strategy keeps your brand top of mind — and leads to more signed policies.

Get Started with DUI Leads in Florida

Florida insurance agents looking for predictable, high-ROI campaigns should seriously consider DUI mail leads. With the proper targeting and timing, this approach delivers prospects who are actively seeking FR44 coverage, not just browsing insurance quotes online.

LegalGrab specializes in real-time Florida DUI lead generation that complies with state regulations and gets results. Whether you're an independent agent or running a regional agency, we’ll help you launch campaigns that convert without wasting your budget on low-quality clicks.

Ready to Launch a High-Converting FR44 Campaign?

Let LegalGrab help you reach high-intent FR44 insurance leads with precision-timed mail and follow-up strategies that convert. We specialize in compliant, high-ROI campaigns for Florida insurance agents.